Current liabilities are specifically a company’s debts which are due for over a year within a normal operating cycle. Current liabilities are settled by the use of a present user through the use of cash or by creating a new account with liability. How can then a company keep track of all the liabilities that have? It will appear in the company’s balance sheet which also incorporates in it short term debt, accounts to be paid, accrued liabilities and similar other debts.

The most common current liability includes everything from accounts payable, notes payable, taxes payable, accrued wages to unearned income, so to sum up every kind of payable amount within a particular accounting period. If the debt increases in time limit and extends for about a year then it will not be considered a short term liability or current liability. So in Current liability the term current period is to be paid attention to. Payments for long term debt which are made in the current period can however be called Current liabilities.

CL also includes it in unearned income. Because it is also an amount which is received for goods or services but has not been provided. These unearned accounts are usually reported as current debts because they are typically settled within a year. However they might be classified as long-term if the management takes longer than 12 months to provide the money to all the customers.

Objectives:

When a company determines that it has to pay off an economic benefit within a year, they need to record the credit entry as soon as possible for this current liability. It is on the basis of the nature of the received benefit that the company’s accountants should classify it either as their asset or their expense.

Check:

- Simple Interest Formula and Calculator with Examples

- What is EBITDA?

- Capital Adequacy Ratio Formula and Calculations with Examples

To explain it more clearly, let us suppose a car manufacturer receives a huge shipment of exhaust systems from its vendors, and there has been a contract that for this they will get paid $10 million within the next 90 days. Because these materials are not sent in to production immediately, the company’s accountants therefore need to record a credit entry in the section of accounts payable and enter a debit in to the inventory of an amount of $10 million.

When the company pays back the balance that was due to its suppliers, and then the amount payable on its credit is $10 million. For example, if a company receives a tax preparation services from an external auditor for whom there is due of an amount of $1 million within the next 60 days.

The company’s accountants will then record a $1 million debit entry to the audit services and the same amount will go in for Current liabilities.

Importance:

Any kind of bonds, loans and mortgages which are to be paid over a term exceeding one year can be referred to as fixed liabilities or long-term liabilities. However, all the payments which are due for long-term loans in the current accountancy year and they could be considered current liabilities if the amounts were material. The amounts which are due for payment in the long term loans in the current year.

However, amounts which are due to the lenders are never shown as accounts payable but it will be present in the balance sheet of the company, and it will be categorized under the heading of current liabilities. Other current liabilities might be also due for payment according to the terms made when the loan was agreed to, but it often happens so that the lender liabilities are viewed as current vs. long term, and hence they become due within the ongoing current fiscal year or earlier.

Therefore, any late payments from a previous year will be added to in the same position on the balance sheet and under the category of current liabilities which have been paid on time. This might be accompanied with footnotes in the financial statements given by external auditors regarding any previous due payments to lenders, but this is not exactly a common practice.

Any lawsuits regarding payment of loan therefore are required to be shown on audited financial statements, but that does not refer to the fact that this is a common method of audit.

If liabilities are therefore properly classified it will therefore provide useful information regarding investors and any other users of the financial statements. It therefore can be regarded as an essential step for allowing any outsider to comprehend and understand a true picture of an organization’s fiscal health.

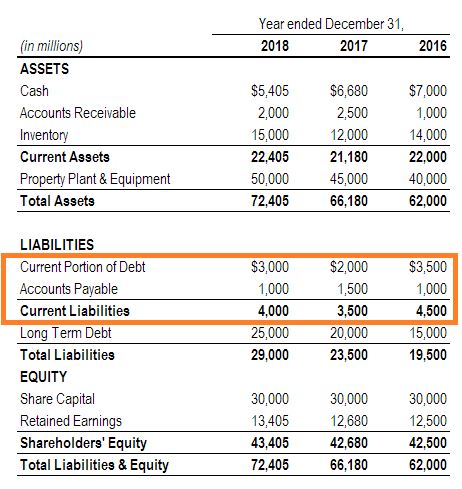

That application which is in the current ratio, defined as the firm’s current assets divided by its current liabilities.

[su_button url=”https://docs.google.com/spreadsheets/d/1stNNwVDtS6qBmum-3SN1o4Fyjob8U0F3Kjn7MFYQ5SM/” target=”self” style=”default” background=”#2D89EF” color=”#FFFFFF” size=”8″ wide=”no” center=”yes” radius=”auto” icon=”” icon_color=”#FFFFFF” text_shadow=”none” desc=”” download=”” onclick=”” rel=”” title=”” id=”” class=””]Download Current Liability Format[/su_button]