In simple interest people will learn about how to calculate simple interest. They will recapitulate the formula for simple interest and know more about this. When people borrow money from any source (bank, agency, moneylender), they will have to pay back the money after a certain period along with some of the extra money for availing the facility to use the money borrowed.

Amortization schedules are significant simply because they actually show you how each and every mortgage payment breaks down into two parts, interest and principal. Along with the knowledge, you will be able to adjust the payments to contain future principal payments that in turn will save you from paying their corresponding interest payments. It actually means that if any specific payment is split up in such a way that requires $200 in principal and $1000 in interest be paid, you will be able to save the $1,000 by paying the $200 before this payment is due. In making these kinds of adjustments, you will be able to save tens of thousands of dollars because you will thriftily be shortening the term of the mortgage.

A brief Overview of Simple Interest:

The loans rarely use simple-interest calculation, but those that do are auto loans and short-term personal loans. The handful of mortgages also uses this specific calculation, most particularly the biweekly mortgage. One of the major causes that this biweekly mortgage assist each and every borrower pay their homes off quicker is that paying the interest more frequently accelerates the payoff date. Along with the simple-interest loans, the lender applies the payment to the month’s interest first; the remainder of the payment decreases the principal. Each and every month, the borrower pays the interest in full so that this never accrues.

One of the primary rules is that if an individual pays the loan late, they will have to pay a lot more money to cover an additional interest and keep the loan’s specified payoff date. This contrasts along with the compound interest that enhances the portion of the old interest to the loan. The lender then calculates some of the new interest on the old interest owed by the borrower. If you talk about simple interest is also rare along with the savings accounts, most of the savings accounts utilize the compounding method to calculate interest.

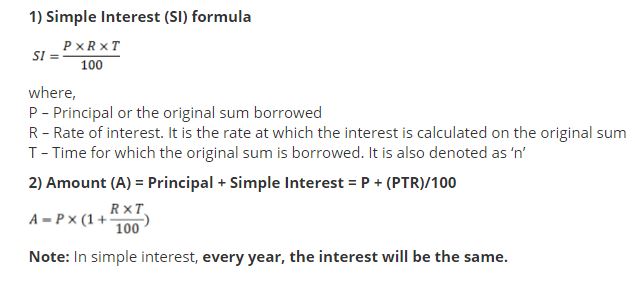

Simple Interest Formula:

When an individual take the loan from the bank or even the financial institution, you are needed to return the shame along with the interest over a stipulated tenure of the loan. Simple Interest formula is one of the very simplest techniques of Interest computation that has been utilized for Short-term loans etc. and this really does not involve compounding of Interest that makes the calculation simple and easy to compute.

Use this simple interest calculator to find A, the Final Investment Value, utilizing the simple interest formula: A = P(1 + rt) where P is the Principal amount of money that is needed to be invested at an Interest Rate R% per period for t Number of Time Periods.

When you understand about the Simple Interest formula, Interest is computed only on an amount initially invested and there is no such interest on interest as the case with Compound Interest Formula. Simple Interest Equation finds the usage in Car Loans and Other Consumer Loans extended by Banks and Financial Institution. Besides, the Interest paid on Saving Banks Account as well as Term Deposits by Banks is also based on Simple Interest equation.

You will have to take a few simple to advanced examples to understand Simple Interest equation:

Simple Interest Formula Example 1:

ABC lends a proper total of $5000 at 10% per annum for the certain period of 5 years. You will have to compute the Simple Interest and total amount due after 5 years.

Principal: $5000

Interest Rate: 10% per annum

Time period (in years) = 5

Then you will have to do the calculation by this utilizing the simple interest equation i.e.

- Simple Interest Formula = Principal * Interest Rate * Time Period

- Simple Interest=$5000 * 10%*5

- =$2500

Total Simple Interest for 5 years= $2500

Amount due after 5 years=Principal + Simple Interest

- = $5000+$2500

- Amount due after 5 years = $7500.

Simple Interest Formula Example 2:

Someone purchases the Microwave Oven from an Electronic Store which is priced at Rs 10000. He financed the same from its lender HDBC Bank. Details as follows:

Loan Amount: Rs 12000

Loan period: 1 year

Interest: 10% per annum

The frequency of Payment: Monthly

People are able to compute the Equated Monthly Amount in EXCEL using the PMT function. Accordingly, the EMI amount that he or she will have to pay comes out to Rs. 879.16 (which includes both interest and Principal amount as well). You will be able to merely observe from the below Amortization schedule of Loan that Interest amount kept lessening along with each payment and Principal Amount kept increasing; though, Monthly Installment remained the same across the tenure of the loan.

Points to Note when Computing Simple Interest:

- The time period should be in years. If this happens for a month, then this must be converted into the years as a fraction.

- Interest Rate also needs to express on an Annual Basis, but if the time period is less than the year then it must be attuned for one year. For example, if the interest rate is 12% per annum, but the problem pertain pertains to Monthly Interest Rate then it will be 1% (12%/12).

The simple interest equation mainly finds the relevance in the way interest is computed by Banks on Savings Bank Account and Term Deposits held by Depositors. Banks usually calculate Interest on the quarterly basis in the Savings and Term Deposits. Returns are simply computed under the Simple Interest, which will be always quite less than the returns computed under the Compound Interest as this avoids the main and basic concept of Compounding.