EBITDA Essentially focuses on the financial outcome of operating decisions. This measure is usually used by people to determine business value. In other words, EDIBTA acts as an alternative method to other metrics such as earnings, net income, and revenue, to effectively measure a company’s financial performance. EBITDA is generally measured by eliminating the impacts of the non-operating decisions taken by the existing management, like tax rates, interest rates, and other significant but intangible assets. Removing that data leaves a figure that reflects the operating probability more effectively in business. This figure can then be efficiently compared amongst companies by buyers, investors, or owners. This is one of the main reasons why many companies choose EBITDA over the other metrics when it comes to deciding the attractiveness of an organization.

What does EBITDA Stand for?

The acronym EBITDA can be broken down to Earnings Before Interest, Taxes, Depreciation, and Amortization. Further mentioned below are the definitions of these key terms.

Interest – Interest is said to be the expenses a business has to incur for interest rates — for example, the loans offered by a bank or a similar third-party.

Taxes – Taxes are the expenses that a business witness because of tax rates which are imposed by a city, state, and even the country as a whole.

Depreciation – Depreciation is the gradual reduction in the value of the company’s assets. This is considered to be a non-cash expense.

Amortization – like depreciation, amortization is also a non-cash expense, which refers to the cost of non-balance sheet (intangible) assets over a certain period.

What are some Drawbacks and Benefits of EBITDA in relation to Business Valuations?

EBITDA has been used to calculate a business valuation for a long time now. The fact that this metric has not been replaced is proof enough that it presents several benefits to analysts, acquirers, and owners when it comes to business valuations. However, this system can be exploited, which further lead to some of its drawbacks in the long run.

Benefits:

- It is widely-used: As said earlier in the article, EBITDA has been very widely used metric by many notable groups, mainly consisting of investors and buyers. This means that mostly all buyers and investors are fluent with this language and can effectively use it to compare business valuations.

- It omits variables which are not required: When calculating with this metric, EBITDA removes all the unhelpful variables like tax rates, interest rates, amortization, and depreciation, which are dependent on businesses. This helps the company acquire a strict illustration of its operating performance.

- It can be easily calculated: all the formulas that are associated with this metric are very straightforward andeasy to determine, given all the data of your financials are accurate. This further makes it a lot easier to understand all sides of any negotiation.

- It is trustworthy: as this metric enables investors to pay full attention to a company’s baseline profitability, EDIBTA is comparatively a more reliable indicator of a company’s financial soundness.

Drawbacks:

Although one of the most talked about the strengths of EDIBTA is that it helps a firm focus on the baseline profitability by eliminating capital expenditure, it is considered to be a potential drawback as well. It has been seen that by ignoring the overall expenditure, it allows companies to undermine any areas of problem in the financial statements. Given the nature of the formula and the information it eliminates, it further overshadows some of the risks in the company’s performance.

EBITDA is not considered to fall under the Generally Accepted Accounting Principles (GAAP). This means that companies can surely interpret the components of the formula in other ways. Such flexibility can help companies hide red flags that potential buyers can pick up on later, which can further result in a loss of trust, money, and time.

That being said, it is advised that you only work with trusted financial advisors who will ensure that you do not overreach in search for the largest EBITDA number. This way, you can also ensure to have a clearer idea of what values you can eliminate from the equation, without causing problems with potential buyers at the due diligence stage.

How do you Calculate EBITDA (EBITDA Formula)?

The formula to calculate EBITDA is relatively straightforward and easy. You have to start by reviewing a company’s income statement. Although EBITDA is not already included on an income statement, it is easy to calculate given the other reported items on every income statement.

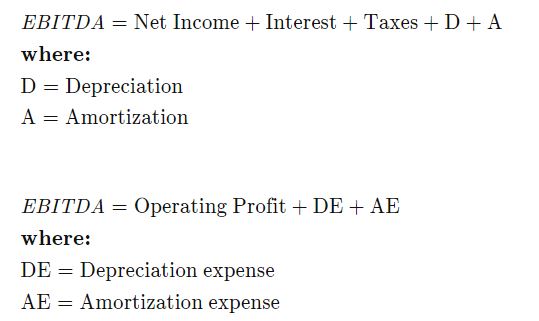

Mentioned below is the formula of EBITDA:

EBITDA = EBIT + Depreciation + Amortization

Along with this formula, you have to find the line items required for Operating Income, or the EBIT, Interest Expense, Depreciation, and Amortization and place it in the formula.

A firm’s EBITDA is the earning of a company before subtracting non-cash amortization and depreciation expenses, along with the taxes and interest expenses.

What is the alternate formula to calculate EBITDA?

If the first formula is a bit cumbersome for your use, there is another easy way you can calculate EBITDA. In this formula, all you have to do is add taxes, interests, depreciation, and amortization with the company’s net income.

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

How to Find a Good EBITDA?

To see if your company’s EBITDA number is ‘good’ or not, you first have to calculate the EBITDA margin.

In other words, the EBITDA margin helps measure a company’s earnings before taxes, interest, amortization, and depreciation as a percentage of the total revenue. Since this formula helps companies know how much cash inflow there is, EBITDA margin is a good measure to calculate how much cash profit your company has made annually, compared to its total sales.

EBITDA Margin = EBITDA / Total Revenue

Why is EBITDA Important?

This operating measure is mostly used by financial analysts. Since this measure minimizes the non-operating effects which are dependent on each company and allows all investors to focus on the operating profitability as a single measure of performance, it is important when similar companies are being compared across a singular industry.